The Institute on Assets and Social Policy (IASP) at the Heller School for Social Policy and Management at Brandeis University has released powerful findings on the destructive long-term impacts of holding student loans, especially for first generation students and students of color.

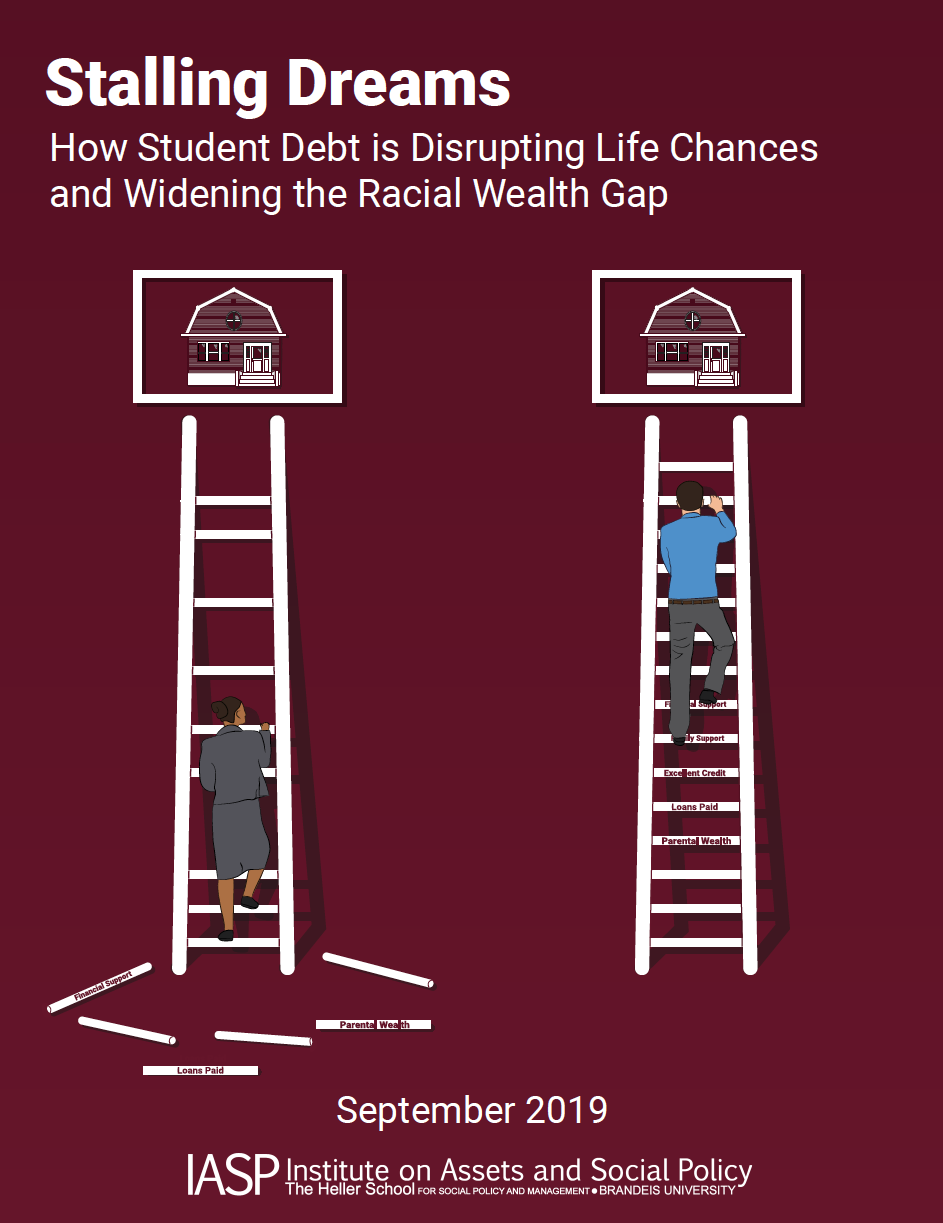

“Stalling Dreams: How Student Debt is Disrupting Life Chances and Widening the Racial Wealth Gap” reveals how student loans widen the racial wealth gap and threaten long-term economic security for those who cannot count on family wealth to support their educational ambitions.

"Black borrowers are much more likely to experience long-term financial insecurity due to student loans,” says IASP Director Thomas Shapiro. “The current higher education financing regime exacerbates inequality, and student loans adversely affect the black-white racial wealth gap."

In an environment where average college tuition toll amounts to 25% of the typical family income, up from 9% in the 1960s, “Stalling Dreams” highlights the long-term impacts as more and more students take on student loans to complete their higher education. Key findings include:

- Loans for a lifetime: Within 20 years, the typical white borrower’s loans are paid, while the typical black borrower has to hold on to a large portion of their loans;

- Default is surprisingly common: More than 25% of all borrowers, 50% of black borrowers and 33% of Latino borrowers defaulted on their loans within 20 years;

- Impacts on racial wealth disparities are stark: In their 30s, a typical white individual with no student loans holds more than $35,000 in wealth, while a typical black individual is more than $10,000 in debt;

- Student debt cuts into overall wealth: Having ever held student debt curtails wealth at age 30 for everyone by about $8,200, independent of the value of current student loan debt.

“While the student loan system was designed to provide access to higher education, it has turned into a debt sentence for borrowers from low wealth backgrounds, first generation and black students,” says IASP Associate Director Tatjana Meschede, associate Director of IASP and co-author of the report. “The student loan financing system is clearly failing our students when default is not an aberration, but instead a regular experience among student loan borrowers.”

“Stalling Dreams” focuses on long-term debt holdings, defaults, and wealth holdings in the first and second decades after attending college. The report underscores the urgency for a shift in college financing and shows that the current debt crisis requires a public re-investment solution.

The authors emphasize that higher education is a core engine of economic growth, and an educated workforce a public good that benefits all. Therefore, a public commitment to supporting students in higher education is needed, helping current student loan holders as well as future generations. With student debt cancelation on the policy agenda for the 2020 presidential race, the authors of “Stalling Dreams” argue that this is a crucial moment to reverse the damage of American disinvestment in higher education.

About IASP

The Institute on Assets and Social Policy (IASP), located at the Heller School for Social Policy and Management at Brandeis University, works to improve our understanding of inequality by examining how assets and asset-building opportunities impact the well-being, financial security, and social and economic mobility of individuals, families and communities, particularly those left out of America’s economic mainstream. In collaboration with our research partners, constituency groups, and practitioner organizations, we use a racial equity lens to explore the role that assets play in inequality and insecurity, and the structural and institutional barriers to asset development.

REPORT AUTHORS:

Laura Sullivan, Tatjana Meschede, Thomas Shapiro, and Fernanda Escobar