Stable communities are critical for families' well-being and their economic security. Central to stable communities are housing stability and the presence of high-quality, community-based resources such as public schools that provide the necessary foundation for families to build assets and participate fully in the nation's economy throughout their lives. IERE's work focuses on a range of housing and community assets, including projects on housing instability and homelessness, housing-based asset building initiatives, and the impact of the history of racial segregation on ongoing and entrenched inequality in accessing community resources. As policy proposals that will further privatize community resources loom on the horizon, IERE seeks to research new policies that would distribute opportunity more equitably, and to understand how we can leverage community power and assets to better protect families.

IERE research in Housing and Community Stability addresses many areas including homelessness, housing interventions, and asset-building initiatives integrated into housing programs.

Significant findings in the area of Housing and Community Stability include:

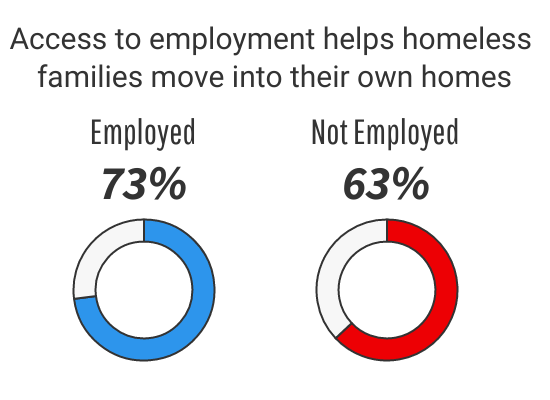

Homeless families living in congregate housing can and do work, and being employed can help families to leave shelters sooner.

The final report from a multi-year evaluation of a demonstration project integrating employment services into housing services for homeless families shows that, with the right supports in place, homeless parents can get jobs. And those in the program who got jobs were more likely to leave shelters within a year after program entry (73% vs. 63%). However, jobs tend to be low-wage and may not support long-term stability.

(Accessible description: The graph above shows in two circles the percent of families who left shelter within one year. Among homeless families who were employed, 73 percent left shelter. Among those not employed, just 63 percent left shelter.)

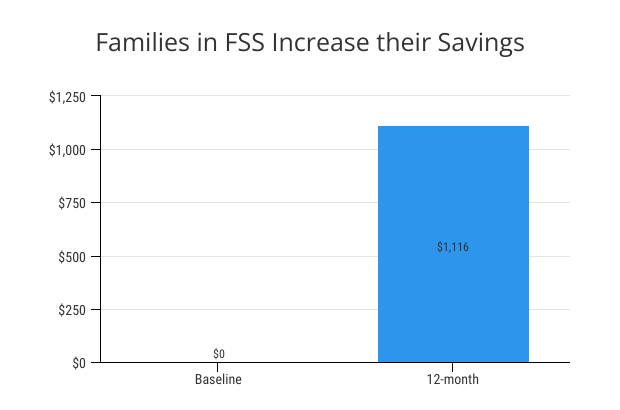

Financial support programs embedded into public housing can help families to move toward self-sufficiency.

Findings from a multi-year study of a Maine asset-building initiative for families in public housing, the Family Self-Sufficiency (FSS) model, suggest important implications for program development, policy, and research. The Enhanced FSS program in Bangor, Maine, helped participants increase employment and income, improve credit scores, build savings and work to reduce debt. Collectively these participant outcomes speak to the benefits of aligning the FSS program with key supports including work advancement, asset-building, and financial capability through strategic collaborations with providers in the community.

(Accessible description: The bar graph above shows that families in Maine’s Family Self-Sufficiency program were able to save an average of $1,116 in their first 12 months in the program.)

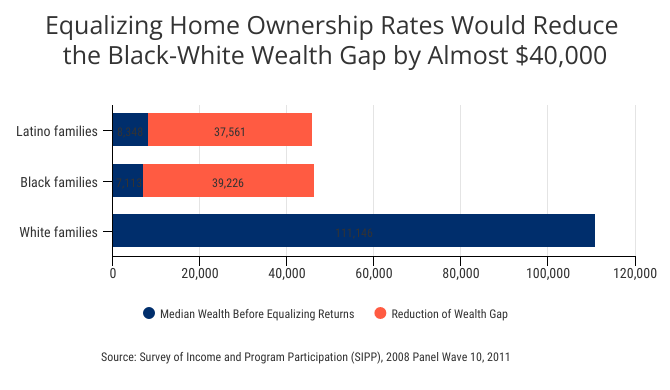

Black families own homes at rates persistently lower than do white families in spite of gains in income over time.

As part of the Racial Wealth Audit project, we find that black families face many challenges to owning their homes, including past and present discrimination in the housing and financial markets, few and small inheritances, and predatory lending practices that target communities of color. Equalizing home ownership rates would contribute significantly to closing the racial wealth gap.

(Accessible description of the equalizing home ownership graph)