- Tracking the growth and development of CSA programs

- Evaluation of Massachusetts’ BabySteps CSA

- Equitable design: Outreach and operations strategies to enhance CSAs’ inclusiveness

- Policy diffusion: How do CSAs grow and spread?

- Metrics for success: What makes a CSA successful?

- Understanding the funding landscape: Public and private funding sources for CSAs

- Overview of research on CSAs

Our Work on Children’s Savings Accounts

Research Team

Tom Shapiro

Madeline Smith-Gibbs

Recent Work

Tracking the Growth and Development of CSA Programs

As part of our work with the Charles Stewart Mott Foundation, a major funder of CSA work across the country, the IERE CSA team:

- Develops metrics for quality and growth

- Tracks development and growth of the field

- Convenes CSA stakeholders in annual meetings

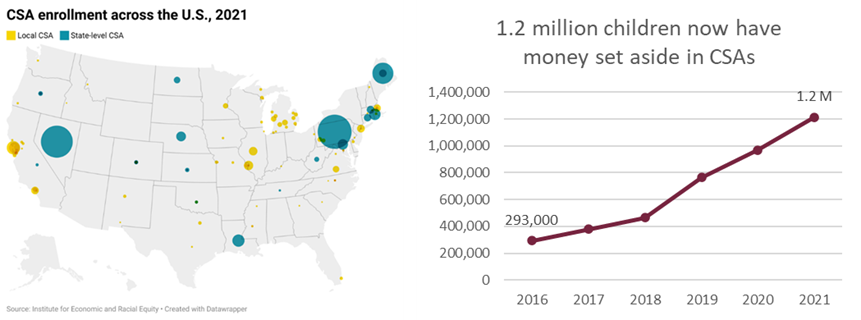

Over the last 25 years, states, cities, localities, and non-profit organizations have implemented CSA programs to expand educational opportunity, boost the education level of the workforce, and address poverty in their communities. Recent years have seen exponential growth, and IERE’s CSA team has worked with its partners to track that growth. From 2016 to 2021, the field has grown from 293,000 accounts to over 1.2 million. As of 2021, 129 CSA programs were operating in 38 states, plus the District of Columbia.

Prior Work

Evaluation of Massachusetts’ BabySteps CSA

Launched in January 2020, Massachusetts’ statewide CSA, BabySteps Savings Plan, provides a $50 seed deposit when families open a Massachusetts 529 account and name a child the beneficiary within one year of the child’s birth or adoption. The program provides a jump-start to families saving for education after high school, including college, vocational school, and apprenticeship costs.

Our evaluation employed a mix of administrative data, interviews with families of young children, and focus groups with BabySteps administrators and partners to measure BabySteps’ successes and identify challenges to address in coming years. Specifically, we sought to understand how BabySteps affected 529 enrollment in low-income communities and communities of color, how families of eligible children are experiencing the program, and what barriers keep families from enrolling and engaging with the program.

Equitable Design: Outreach and Operations Strategies to Enhance CSAs’ Inclusiveness

By letting children know from a young age that they have assets in their name saved for education after high school, CSA programs aim to help children see themselves as college-bound. Indeed, CSAs are a key part of advancing equity in educational access. Children’s Savings Accounts: A Core Part of the Equity Agenda briefly outlines how CSAs fit with other efforts to boost access to postsecondary education for those who have historically been left out.

The day-to-day choices CSAs make in operations and outreach greatly impact how their programs are experienced by children and families. Seeds of Equity: Fostering Inclusivity in Children’s Savings Account Programs shares insights from the staff of 14 CSA programs on what barriers to inclusion families may face in CSA programs and how they can be addressed, spanning topics like:

- How might a CSA program respond when community members are suspicious of “free money”?

- In the face of the COVID-19 pandemic and reduced in-person contact, how are programs reaching families affected by the digital divide?

- How can messaging about the value of higher education be tailored to the specific values of different communities?

Policy Diffusion: How Do CSAs Grow and Spread?

As a region, New England is home to rapid growth and innovation in CSA policy and practice. This case study tells the story of New England’s collaborative, regional approach to CSA development and innovation. Under the leadership of the Federal Reserve Bank of Boston’s Regional and Community Outreach Department, key stakeholders across New England formed a Consortium in 2014 to learn about, develop, and advance CSA policy. Today, New England is home to an array of large and small programs, including some of the longest-running CSAs in the country. This type of policy growth is impressive, given the wide range of programmatic models, the complex and multi-sector nature of CSA design and implementation, and the long-term public and private investments required. This report explores the lessons learned from New England’s regional approach to developing, implementing, and innovating CSAs. New England’s notable progress on CSAs was facilitated by creating a space for policy makers and program administrators to continuously learn from each other, the support of effective leaders, and advocates seizing opportunities for policy progress.

View the report here: Cultivating CSAs: The Growth and Spread of Children's Savings Accounts in New England.

Metrics for Success: What Makes a CSA Successful?

Metrics for Success: What Makes a CSA Successful?

Across the U.S. CSAs vary in program design and structure, ranging from a limited savings match on deposits to a privately owned account, to a universal seeded program. CSAs can be universal or targeted (or a hybrid design); they can be opt-in or automatic; and they can provide seeds, matches, and other incentives. Because CSAs are relatively new in implementation, no consensus has yet been reached on the optimal structure for CSA programs. And indeed, there may be no single optimal CSA design; instead, local goals and resources will help to shape each community’s CSA. To build an understanding of what components are important to CSA success, IERE conducted a literature review to identify features of CSA programs that are associated with high levels of uptake and engagement by low- to moderate-income families, as well as features that contribute to the long-term sustainability of CSAs. Read more in IERE’s literature review of CSAs: Levers for Success: Key Features and Outcomes of Children's Savings Account Programs.

Understanding the funding landscape: Public and private funding sources for CSAs

CSAs’ funding structures vary, with both public and private funds providing essential support for the growing number of programs across the U.S. In partnership with Asset Funders Network (AFN), IERE has been studying the sources of funding and in-kind support for CSAs:- Children's Savings Account Survey of Private and Public Funding 2021

- Children's Savings Account Survey of Private and Public Funding 2019

- Children's Savings Account Survey of Private and Public Funding 2017

- Children's Savings Account Survey of Private Funding 2015-2016

In 2020, CSA programs and their funders grappled with the COVID-19 pandemic and responded to calls for racial equity. To read our report on anticipated changes to the funding landscape and how CSA programs would like to respond to communities' pandemic- and equity-related needs, read our report Looking to the Future: The Children’s Savings Field Reacts to COVID and Racial Equity.

Philanthropy plays an essential role in the growth and success of CSAs across the country. Our 2019 report, Investing in the Future of Our Community, examines what motivates funders and potential funders to consider investing in CSAs, how funders evaluate CSA success and shape the future of programs, and what challenges may deter funders from investing in CSAs. The project draws upon insights from interviews with 24 respondents in three regions, spanning committed funders, uncommitted funders, and CSA advocates.

Overview of Research on CSAs

The evidence base supporting CSAs has grown tremendously in recent years, with promising findings on interim and long-term outcomes related to education, health, equity, and economic mobility. This guide, published in 2018 in partnership with Prosperity Now, summarizes current research on CSAs’ effects and outcomes in these domains, offering a quick reference to the types of research backing each finding. The guide also summarizes research on how CSA program design features affect participation, savings, and account accumulation. See the guide here: Quick Guide to CSA Research.