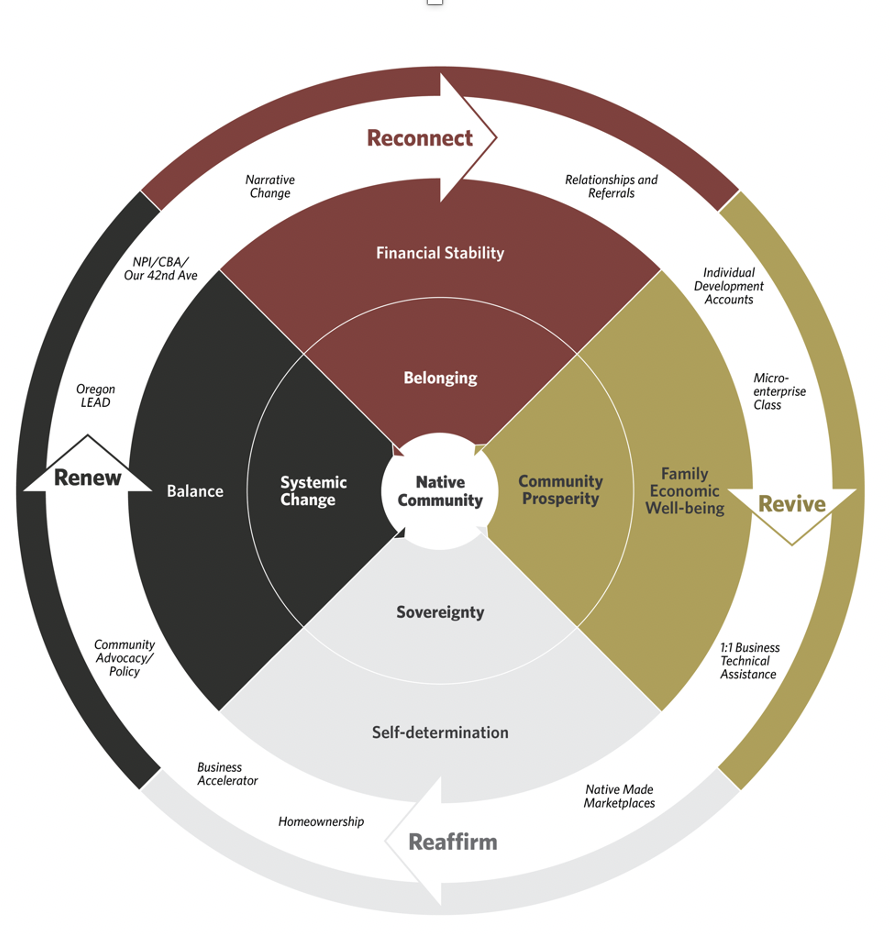

Released in partnership with the Native American Youth and Family Center (NAYA) in Portland, Oregon, Balance and Belonging: Empowerment Economics and Community Development at NAYA is the third case study in a multi-year, research partnership exploring Empowerment Economics. This case study report highlights NAYA's culturally rooted, holistic approach to community development and its Individual Development Account (IDA) program, as shown in the figure below.

Figure 1: NAYA’s Approach to Community Development

(Accessible description of Figure 1: NAYA’s Approach to Community Development)

These multi-level outcomes happen simultaneously through the department’s numerous programs that address the needs of Native community members in various seasons of life. Some people come to NAYA seeking to reconnect with their Native heritage; walking in deep relationship with clients, staff offer referrals to NAYA’s wraparound services so that participants are financially stable and feel a sense of belonging. The department uses a culturally connected approach to financial wellness to support people in reviving and achieving their dreams of family economic well-being and community prosperity. The Community Development department fosters the cultivation of self-determination and sovereignty, reaffirming that participants and the Native community have power. Finally, through its community-driven policy and advocacy work, the Community Development department creates systemic change and restores balance, renewing participants’ connections to their Native identity, community, and land and improving the lives of seven generations to come. As participants experience different seasons of life, they flow in and out of the Community Development department’s programs; ultimately, they leave with a greater sense of balance and belonging.

Download Balance and Belonging: Empowerment Economics and Community Development.

View a recording of the Oregon Economic Justice Roundtable’s December Convening, which features a presentation on the report and implications (introduction of the presentation starts at 15:48).